Claims processing forms a critical role within an insurance company. The process is often slow due to the meticulousness required when checking and verifying the client’s claims. The claims processing team has the noble task of ascertaining the client’s losses, issue settlement notices, assess the damages, and ultimately process payments.

Claims submitted from online forms such as phones and emails have to be keyed in by hand into the claims system. The claims manager is responsible for copying the information into multiple computer systems. Once the claims are put in the system, they are validated for coverage.

Companies that are yet to adopt automated claims processing have it rough when trying to process claims. In the event of catastrophic environmental hazards, processing such claims can prove very difficult. This is why most insurance companies are leaning towards automating their claims process.

What is Claim Processing?

This process forms the core of any insurance company. When an insured person incurs any form of damage covered by the policy, the client is required to submit a detailed claim on the nature of the damage. This information helps the insurance agent to review the claim.

If the claim passes all necessary steps and is approved, the insurer will compensate the policy’s owner. These claims pass through a vigorous vetting process to ensure they follow the regulatory requirements.

Most companies turn to automation to review insurance claims, as the benefits of this incoming technology cannot be overlooked. RPA (Robotic Process Automation) is used for various reasons. Including determining fraudulent claims.

AI also works similarly; by enabling the companies to deal with complicated claims, they can also accurately process claims in areas affected by natural disasters. This speeds up the claims processing as the effectiveness of the AI is beyond question.

Automation simply outdoes the “traditional” way of handling insurance claims. Here is a quick look at some benefits of the automated claims policy.

1. Reduced Data Entry

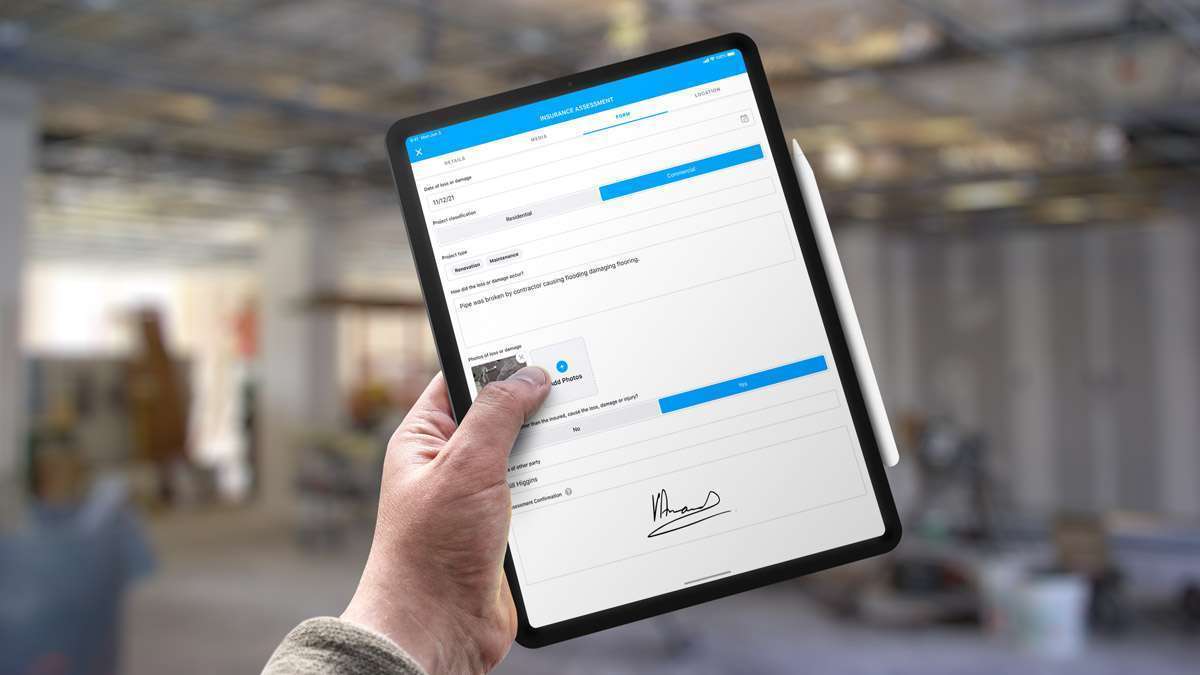

Customers need to fill in forms in their claiming process. However, automation eliminates the need for this manual entry as it reads the information straight from the forms and inputs it into the system. With data processing contributing to one of the highest costs incurred, reduced data entry saves the company a lot of money.

2. Completes all Applications

Incomplete data can be a significant hindrance to quick insurance claims processing. When you are trying to complete an insurance claim, different documents are needed. Most people will miss a step, and the documents are sent back.

Automation gives you a detailed step-by-step procedure, and you are sure not to miss any step.

3. Leaves an Audit Trail

Auditing becomes an easy process when using automation. This means the software can create a trail that is easily accessible while conducting audits.

4. Eliminating the Need for Storage

The paperwork involved in manual claim processing needs to be stored by the insurance companies for further references. Maintaining a physical archive may prove very hard; electronic archives, on the other hand, are easy to maintain.

The Challenges of Natural Disasters

Natural disasters are increasingly becoming a menace. This trend has led to many insurance companies taking measures to ensure their technical performance is stabilized. Hurricanes, storms, floods, and earthquakes could hinder any attempts to a claim.

We at Gruntify have all these in mind, and we know and understand your need for professional quality service. We use artificial intelligence-powered programs used for a large number of claims. Ranging from catastrophic events to natural disasters.

What Our Software Can Do

Our software will combine machine learning technologies with satellite, aerial imagery, and property data to quickly assess the damage caused by tornados, hurricanes, floods, wildfires, and other disasters. This will significantly improve the sped of the payment of customer’s claims.

Gruntify will accurately assess all damages and ensure rapid claims payment to the insurers living in disaster-prone areas. It also improves service delivery and accuracy, making us serve you better.

Once a disaster happens, and you give us a call, we will visit the affected property and inspect the damage caused. Using smart location and proprietary algorithms, Gruntify can automatically distribute the work among the field workforce.

Our software will assess all types of possibilities. We utilize the available resources to ensure we cover all areas such as adjusters’ location, the type of buildings affected, whether residential, commercial, or industrial.

Our team is then able to process the information quickly, and the insurance claim processing starts. The insurer can then track the progress of the claim to the point where the damage is repaired.

Our successful implementation of the use of automation has ensured that Gruntify can:

- Lower the costs of the automated job functions while, in the long run doubling their efficiency.

- Achieve incredible accuracy in service delivery.

- Speed up service delivery, especially in areas affected by natural disasters.

- Increase profitability and business productivity.

- Ensure that our services are 100% compliant with the regulations.

- Save work hours by the use of AI technology in the field.

The Key Takeaway

Overall, the potential for automation in the insurance industry is priceless. Insurance organizations can successfully process claims accurately and faster. Areas affected by natural disasters too can be easily accessible and the claims handled in time. Contact us for a demo that gives you a firsthand view of how easy it is to make data-driven decisions.